DCTA Recognized for Ensuring Financial Transparency

The Denton County Transportation Authority's commitment to financial transparency has earned a Traditional Finances star from the Texas Comptroller. This award recognizes governmental agencies that provide allowable access to financial data, including all spending and revenue information within the agency.

The DCTA’s consistent dedication to ensuring transparency of the Authority’s financial records has earned high marks at both the state and national level. Learn more about transparency qualifications.

The DCTA also has been recognized by the Government Finance Officer Association of the United States and Canada with a Certificate of Achievement for Excellence in Financial Reporting. The Certificate of Achievement is the highest form of recognition in the area of governmental account and financial reporting. DCTA has been awarded the Certificate of Achievement for Excellence in Financial Reporting Program by Government Finance Officers Association for ten consecutive years.

The DCTA has also been awarded the Distinguished Budget Presentation Award by the Government Finance Officers Association for 15 consecutive years. The Distinguished Budget Presentation Award ensures that DCTA submits a high-quality budget which focuses on budgetary transparency and accountability within the agency. By receiving this award, DCTA is meeting guidelines established by both the National Advisory Council on State and Local Budgeting and the Government Finance Officers Association.

Finance Summary

The financial detail below is related to the fiscal year ended September 30, 2022 and includes the past six fiscal years for comparison when applicable. The per capita base is calculated using Denton population numbers and is detailed below:

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| Population | 814,690 | 843,260 | 873,220 | 901,120 | 933,220 | 950,660 | 1,006,492 |

Revenues and Expenses per Capita (Last Seven Fiscal Years)

NOTE: DCTA does not receive income from property taxes. Sales tax is collected through a one-half percent sales tax from DCTA's three member cities - Denton, Highland Village and Lewisville.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| Revenue Per Capita | $45.5 | $46.0 | $47.1 | $56.9 | $63.1 | $70.00 | $56.09 |

| Expenditures Per Capita | $52.9 | $48.4 | $50.6 | $46.2 | $42.9 | $56.10 | $51.26 |

| Sales Tax Per Capita | $32.9 | $33.1 | $32.9 | $33.1 | $37.9 | $40.78 | $40.03 |

Revenues

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| Revenue | $37,096,155 | $38,811,540 | $41,169,210 | $51,300,491 | $58,897,658 | $66,565,175 | $56,540,523 |

| Revenue Per Capita | $45.5 | $46.0 | $47.1 | $56.9 | $63.1 | $70.02 | $56.09 |

| Sales Tax Per Capita | $32.9 | $33.1 | $32.9 | $33.1 | $33.1 | $40.78 | $40.03 |

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| Operating Revenue | $5,405,656 | $5,389,383 | $5,769,167 | $4,639,923 | $3,931,563 | $5,331,307 | $6,725,842 |

| Sales Tax Revenue | $26,790,098 | $27,937,707 | $28,735,383 | $29,817,365 | $35,332,154 | $38,764,986 | $40,292,936 |

| Operating Assistance Grants | $4,900,401 | $5,484,450 | $6,664,660 | $16,843,203 | $19,633,941 | $22,468,882 | $9,431,745 |

| Total | $37,096,155 | $38,811,541 | $41,169,210 | $51,300,491 | $58,897,658 | $66,565,175 | $56,450,523 |

Expenses

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| Expenses | $43,103,788 | $40,852,280 | $44,204,389 | $41,604,129 | $40,020,204 | $53,329,698 | $51,588,096 |

| Expenditures Per Capita | $52.9 | $48.4 | $50.6 | $46.2 | $42.9 | $56.10 | $51.26 |

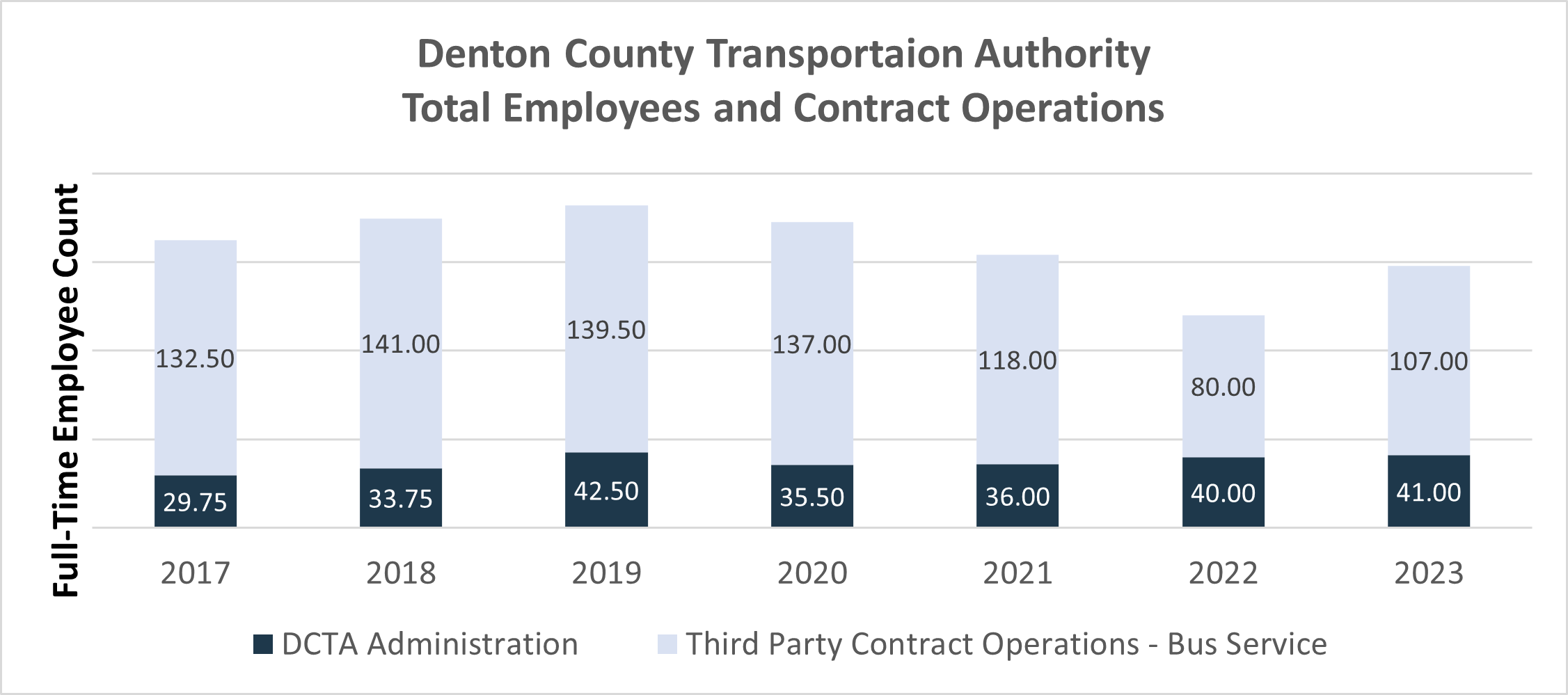

Total Employees and Contract Operations (Last Seven Years)

NOTE: Figures represent total head count as of fiscal year end.

Operating Statistics

Last Ten Years

Source: National Transit Database Annual Agency Profiles and Forms S-10 and FFA-10 for 2012-2020; Forms S-10 and FFA-10 submitted January 2022 for 2021 year

Actual Vehicle Revenue Miles

Actual Vehicle Revenue Miles: The miles a vehicle travels while in revenue service. This definition includes layover and recovery, but excludes travel to and from storage facilities, the training of operators prior to revenue service, road tests, deadhead travel, and school bus and charter service. For A-train, this is defined as passenger car revenue miles.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|

| Demand Response Directly Operated Transportation | 226,065 | 276,159 | 260,833 | 264,591 | 284,103 | 204,413 | 135,902 |

| Fixed Route Bus Directly Operated Transportation | 1,403,748 | 1,482,110 | 1,626,951 | 1,625,328 | 1,643,943 | 1,307,863 | 1,190,682 |

| A-train Rail Purchased Transportation | 651,117 | 644,711 | 533,081 | 328,658 | 671,222 | 563,846 | 501,786 |

| VanPool Purchased Transportation | 618,963 | 822,901 | 785,538 | 689,889 | 718,019 | 1,005,519 | 1,491,900 |

| Demand Response Taxi Purchased Transportation | - | - | 13,766 | 61,695 | 97,277 | 67,987 | 67,179 |

| Demand Response Purchased Transportation | - | - | - | - | - | - | 64,204 |

| Total Actual Vehicle Revenue Miles | 2,899,893 | 3,225,881 | 3,220,169 | 2,970,161 | 3,414,564 | 3,149,628 | 3,451,653 |

Actual Vehicle Revenue Hours

Actual Vehicle Revenue Hours: The hours a vehicle travels while in revenue service. This definition includes layover and recovery, but excludes travel to and from storage facilities, the training of operators prior to revenue service, road tests, deadhead travel, and school bus and charter service. For A-train, this is defined as passenger car revenue hours.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|

| Demand Response Directly Operated Transportation | 17,614 | 24,452 | 24,659 | 21,031 | 21,741 | 15,993 | 11,841 |

| Fixed Route Bus Directly Operated Transportation | 116,874 | 126,214 | 135,091 | 137,411 | 138,881 | 105,124 | 89,675 |

| A-train Rail Purchased Transportation | 26,295 | 26,145 | 21,044 | 13,208 | 27,530 | 26,354 | 23,285 |

| VanPool Purchased Transportation | 11,072 | 14,706 | 14,689 | 14,935 | 17,842 | 23,774 | 26,969 |

| Demand Response Taxi Purchased Transportation | - | - | 1,097 | 3,969 | 6,209 | 4,129 | 4,017 |

| Demand Response Purchased Transportation | - | - | - | - | - | - | 4,470 |

| Total Actual Vehicle Revenue Hours | 171,855 | 191,517 | 196,580 | 190,554 | 212,203 | 175,374 | 160,257 |

Unlinked Passenger Trips

Unlinked Passenger Trips: The number of passengers who board public transportation vehicles. A passenger is counted each time the passenger boards a vehicle even though the passenger might be on the same journey from origin to destination.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|

| Total Annual Unlinked Passenger Trips - Bus | 2,400,699 | - | - | - | - | - | - |

| Total Annual Unlinked Passenger Trips - Rail | 555,423 | 545,250 | - | - | - | - | - |

| Total Annual Unlinked Passenger Trips - VanPool | 134,662 | 199,044 | 145,020 | 128,089 | 128,171 | 154,811 | 216,450 |

| Total Annual Unlinked Passenger Trips - Taxi | - | - | 1,716 | 7,576 | 13,710 | 10,568 | 10,247 |

| 3,090,784 | 744,294 | 146,736 | 135,665 | 141,881 | 165,379 | 226,697 |

Annual Passenger Miles

Annual Passenger Miles: The sum of miles traveled by passengers, calculated by multiplying the average miles traveled per passenger by the total number of boardings.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|

| Demand Response Directly Operated Transportation | 224,700 | 207,853 | 202,774 | 204,529 | 260,791 | 204,243 | 135,765 |

| Fixed Route Bus Directly Operated Transportation | 6,345,512 | 6,322,593 | 5,918,755 | 5,828,301 | 5,748,291 | 3,182,297 | 1,675,782 |

| A-train Rail Purchased Transportation | 8,175,102 | 8,000,309 | 7,298,558 | 5,901,029 | 5,493,329 | 3,039,904 | 1,531,530 |

| VanPool Purchased Transportation | 3,258,528 | 6,439,172 | 6,119,250 | 5,618,847 | 5,787,405 | 7,205,612 | 10,788,190 |

| Demand Response Taxi Purchased Transportation | - | - | 13,923 | 61,441 | 97,339 | 68,014 | 67,302 |

| Demand Response Purchased Transportation | - | - | - | - | - | - | 53,733 |

| Total Annual Passenger Miles | 18,003,842 | 20,969,927 | 19,553,260 | 17,614,147 | 17,387,155 | 13,700,070 | 14,252,302 |

Operating Expenses

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|

| Demand Response Directly Operated Transportation | $ 1,429,741 | $ 1,703,434 | $ 2,225,894 | $ 2,421,592 | $ 3,027,013 | $ 2,557,881 | $ 1,967,427 |

| Fixed Route Bus Directly Operated Transportation | 9,934,604 | 10,956,771 | 11,877,125 | 12,657,498 | 13,838,874 | 13,165,615 | 11,555,180 |

| A-train Rail Purchased Transportation | 13,429,333 | 12,757,014 | 13,528,182 | 13,680,466 | 15,446,441 | 14,086,602 | 13,623,014 |

| VanPool Purchased Transportation | 356,865 | 430,362 | 392,099 | 386,402 | 424,355 | 605,409 | 735,614 |

| Demand Response Taxi Purchased Transportation | - | - | 187,927 | 281,604 | 364,491 | 303,210 | 374,351 |

| Demand Response Purchased Transportation | - | - | - | - | - | - | 620,655 |

| Total Operating Expenses | $ 25,847,581 | $ 25,847,581 | $ 28,211,227 | $ 29,427,562 | $ 33,101,174 | $ 30,718,717 | $ 28,876,241 |

The budget is a policy tool used by staff and the Board to establish goals and deliver the services defined in the Service Plan of the agency, as well as serving as the foundation for DCTA’s long range financial model. The budget identifies the source and use of funds expended by DCTA and communicates the priorities and informs Denton County citizens about the financial condition of the agency.

Chapter 460 of the Texas Transportation Code requires the preparation of an annual budget for DCTA. Staff has prepared a balanced budget, where operating expenses and capital expenditures do not exceed current year revenues and undesignated fund balance/reserves.

The proposed FY 2022 Budget was presented and discussed at the DCTA Budget Workshop on June 17th. On August 26th the FY22 Proposed Budget was again presented to the Board of Directors at the Board meeting, in accordance with requirements under Chapter 460 of the Texas Transportation Code and DCTA Board policy and procedures, for Board review and comment as well as citizen input. Notice of the public hearing was published in the Denton Record Chronicle on August 13, 2021.

The FY 2022 Operating & Capital Budget was adopted by the DCTA Board of Directors on September 23, 2021 and the NTMC Board of Directors on September 29, 2021.

ADOPTED OPERATING & CAPITAL BUDGETS

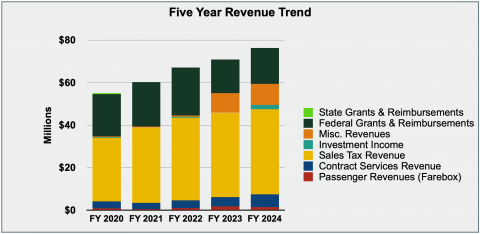

5 Year Revenue Trend

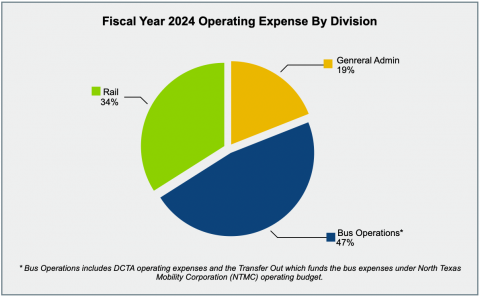

FY24 Operating Expense by Division

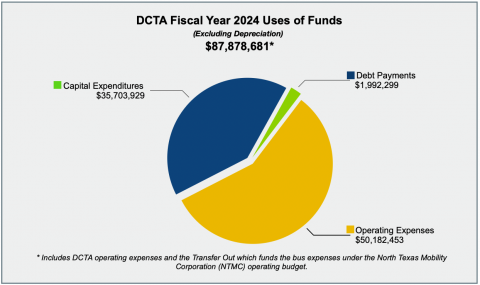

FY24 Uses of Funds

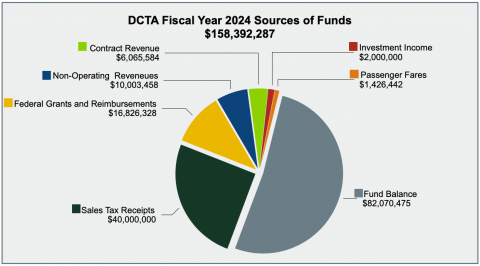

FY24 Sources of Funds

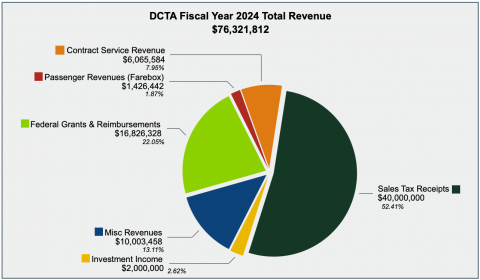

FY24 Total Revenues

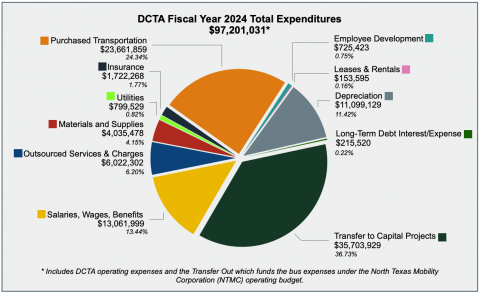

FY24 Total Expenditures

This report provides a quantitative look at the operating success, financial health, and compliance of the government report units. It includes a statement of net position, a statement of changes in financial position, a cash flow statement, and a comparison of budgeted to actual expenses and revenues.

FY 2023 Comprehensive Annual Financial Report

FY 2022 Comprehensive Annual Financial Report

FY 2021 Comprehensive Annual Financial Report

FY 2020 Comprehensive Annual Financial Report

FY 2019 Comprehensive Annual Financial Report

FY 2018 Comprehensive Annual Financial Report

FY 2017 Comprehensive Annual Financial Report

FY 2016 Comprehensive Annual Financial Report

FY 2015 Comprehensive Annual Financial Report

FY 2014 Comprehensive Annual Financial Report

FY 2013 Comprehensive Annual Financial Report

FY 2012 Comprehensive Annual Financial Report

FY 2011 Comprehensive Annual Financial Report

FY 2010 Basic Financial Statements

FY 2009 Basic Financial Statements

FY 2008 Basic Financial Statements

FY 2007 Basic Financial Statements

Check Register (xlsx)

A check register is a listing of all payments incurred during a pay period by the Agency. The register includes payment date, payee, payment amount and a general description of the transaction. The information is compiled and totaled by monthly transactions. To adjust the month that is currently being viewed, use the drop-down selection in cell E1 of the Excel Document.

Texas Transparency Organization

The Texas Comptroller of Public Accounts' Texas Transparency website provides visitors with detailed information about state spending, datasets you can download and use, links to local government transparency efforts, and general information about the state budget process.

Debt Information

Summary information about outstanding debt including debt obligations, descriptions, dates issued, total amounts and maturity dates.

Current Tax Rates

DCTA collects a one-half percent sales tax in member cities – Denton, Highland Village and Lewisville.

Public Information Request

DCTA Board of Directors

DCTA General Contact Information

Customer Service

940.243.0077

604 East Hickory St. Denton, TX 76205

Hours of Operation

Monday through Friday: 7 a.m. - 7 p.m.

Saturday and Sunday: Closed

Administrative Offices

1955 Lakeway Drive, Suite 260

Lewisville, TX 75057

Mailing Address

P.O. Box 96

Lewisville, TX 75067